Where Do I Upload Pictures On Etrade Mobile App

What'due south a portfolio?

Being an investor means edifice and managing a portfolio. Fair enough, but how do you do that? Permit'south look at the basics.

A portfolio is actually just a list of your investments. While all your investments taken together might be considered your overall portfolio, investors tin take split portfolios for different purposes—a retirement portfolio, a trading portfolio, and a college fund portfolio, for instance.

If a portfolio is a list of investments, how do you choice what's on that list? This is where two closely related ideas come into play: asset allocation and diversification.

Nugget allocation: Your mix of investments

Your asset allotment is the mix of dissimilar types of investments that you hold. Typically, investors talk well-nigh three main types of investments, or asset classes:

- Stocks, which are also chosen equities

- Bonds, as well known as fixed income securities

- Cash and cash equivalents

Be aware that there are other asset types collectively known as alternatives, which include existent manor, bolt, and more.

These different types of investments have dissimilar degrees of risk and different potential rewards. How you mix them determines your portfolio's overall gamble/advantage balance, which is actually your investment strategy. Information technology could be:

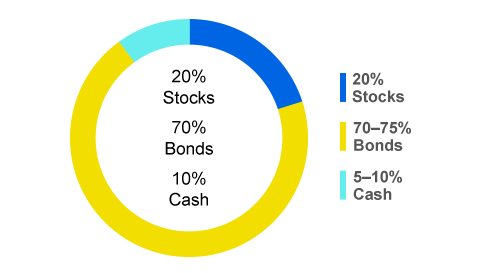

Conservative

This volition typically mean a high percentage of cash and bonds in the portfolio, with the main goal of preserving existing wealth. This is a low risk approach because greenbacks amounts don't decrease, and while the value of a bail investment may change from mean solar day to day, y'all'll generally become your original investment amount back, plus interest payments, if you lot concord a bond until information technology matures.

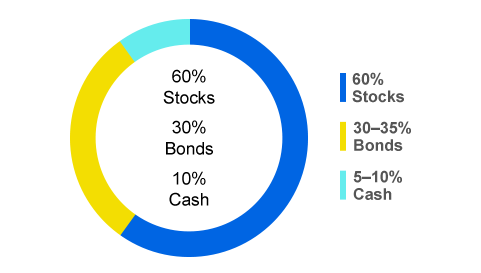

Moderate

This portfolio volition typically have more stocks than the bourgeois approach and aim for some growth with moderate chance.

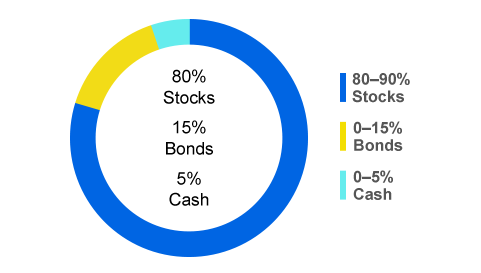

Aggressive

An aggressive portfolio volition generally have a high percent of stocks and a smaller proportion of cash and bonds. The stocks provide a greater potential to brand profits, but also greater hazard and potential for losses.

Many factors can influence how you allocate your assets and build your portfolio. Two important ones are your gamble tolerance and your investing timeframe. Another is diversification.

Diversification

Diversification ways putting your money in a variety of different investments to manage or potentially reduce your adventure. Instead of buying stock in simply one company or one manufacture, you look to buy stocks in many companies of dissimilar sizes, in dissimilar industries, or dissimilar locations. The same thought applies to asset classes. You might make investments not but in stocks only also in bonds, greenbacks, or peradventure even alternatives.

This may reduce risk because if your portfolio is diversified—that is, you've spread your eggs among many baskets—it'south not as vulnerable to taking a big hitting if things go incorrect for a unmarried company or industry.

So how do you go about edifice a diversified portfolio? Ane way is to invest in exchange-traded funds (ETFs) and mutual funds, which provide access to multiple stocks and bonds and invest broadly in the markets. Here are three simple ways to find and invest in ETFs and common funds:

- Eastward*Merchandise screeners. We have a range of screeners and other research tools to aid yous observe the ETFs and mutual funds that are right for you.

- Prebuilt portfolios. These are Eastward*TRADE educational tools that ask you to choose your investment strategy—conservative, moderate, or aggressive—and and then show y'all selections of ETFs or common funds that yous tin purchase to build your portfolio.

- Core Portfolios. This option provides easy, automatic ETF investing backed by the Eastward*TRADE Capital Management investment strategy squad. Yous reply questions about your risk tolerance, goals, and timeframe, and nosotros build your portfolio and manage your investments day-to-solar day for a fee. You'll always stay fully informed and in control of your investment strategy.

Managing your portfolio

Once you lot've built a diversified portfolio that fits your goals, there are some things you should keep an center on and some management tasks you may want to exercise from time to fourth dimension:

- Check functioning. Every then frequently, cheque to see how your investments are doing. How are they performing compared to the broader markets?

- Stay informed. Continue an eye on news and events related to companies and industries that you're invested in. Are there trends or possible future developments that could affect your investments?

- Monitor your asset allocation. Periodically, take a close await at your investment mix to make sure it's still aligned with your investment goals and risk tolerance. E*Merchandise provides tools to help you lot analyze your portfolio and asset resource allotment.

- Rebalance. Equally some of your investments rise in value, and others fall, the remainder in your portfolio can drift away from your original target. Yous may need to periodically rebalance it to ensure your mix of assets stays where yous want it to.

- Adapt to life changes. Over fourth dimension, your appetite for take chances may alter. For instance, it's common for people nearing retirement to try to reduce risk and preserve their savings. Other life changes like having children, getting a raise, or changing jobs tin can also bear upon your investing goals. In those cases, you should remember near whether your asset resource allotment mix needs to alter.

Understanding these basic principles is the first step in building an investment portfolio. Explore Eastward*Merchandise'due south Knowledge Library for much more on portfolios, asset allocation, ETFs, common funds, and other investing and trading topics.

What to read next...

Intro to asset allotment

Nigh investments don't move in the same direction at the same time. If you lot hold unlike types of investments, your winners and losers may residue each other out, resulting in less volatility in your portfolio.

What is a dividend?

A dividend is a payment fabricated by a corporation to its stockholders, unremarkably out of its profits. Dividends are typically paid regularly (e.k. quarterly) and made as a fixed corporeality per share of stock.

Source: https://us.etrade.com/knowledge/library/getting-started/managing-your-portfolio

Posted by: alleyarerest.blogspot.com

0 Response to "Where Do I Upload Pictures On Etrade Mobile App"

Post a Comment